Global Contract with Tax Rates for Value-Added Service (VAS)

Users can set value-add contracts as global contracts, as well as set tax rates for different accessorial codes. Users with the role of Transportation Manager or Transportation Coordinator can configure global contracts.

Complete the following steps to set tax rates and Global Contracts:

L og in to the ONE system.

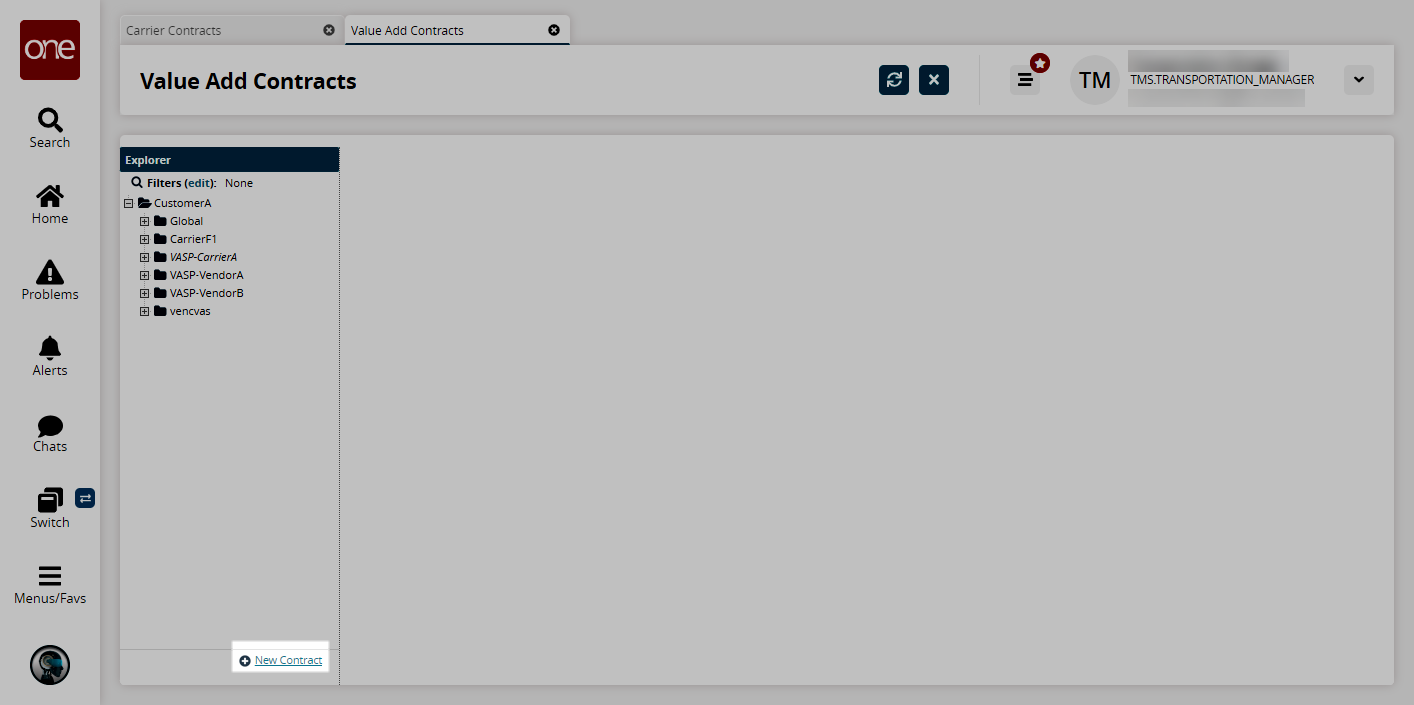

Select Menu/Favs > Contract Mgmt > Value-Add Contracts.

The Value-Add Contracts screen appears.Select the New Contract link.

The right pane updates.Select the Global checkbox and enter the other required information. See the "Creating VAS Contracts" section for more information on these fields.

Note that contracts are restricted because dates cannot overlap with existing contracts.

Click Create Contract.

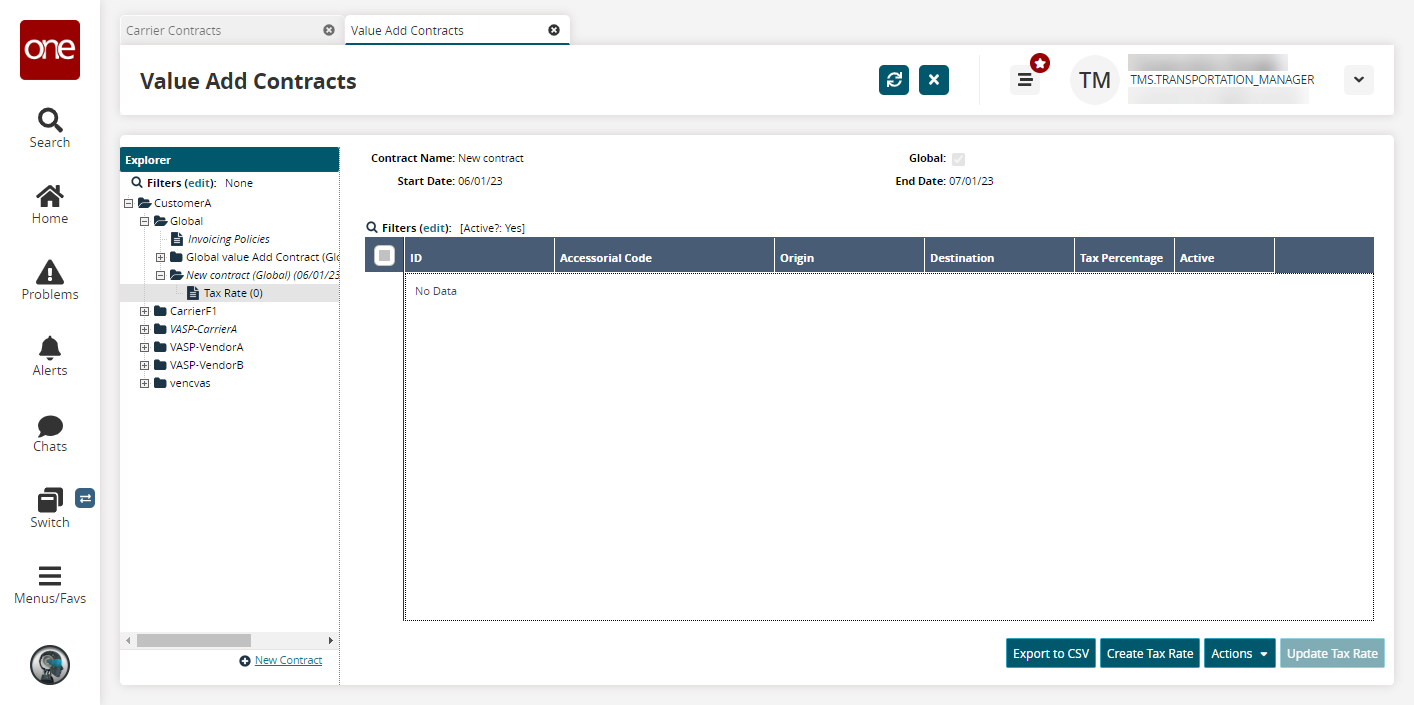

A success message appears.Navigate to Tax Rate under the newly created contract.

The right pane updates.

Click the Create Tax Rate button.

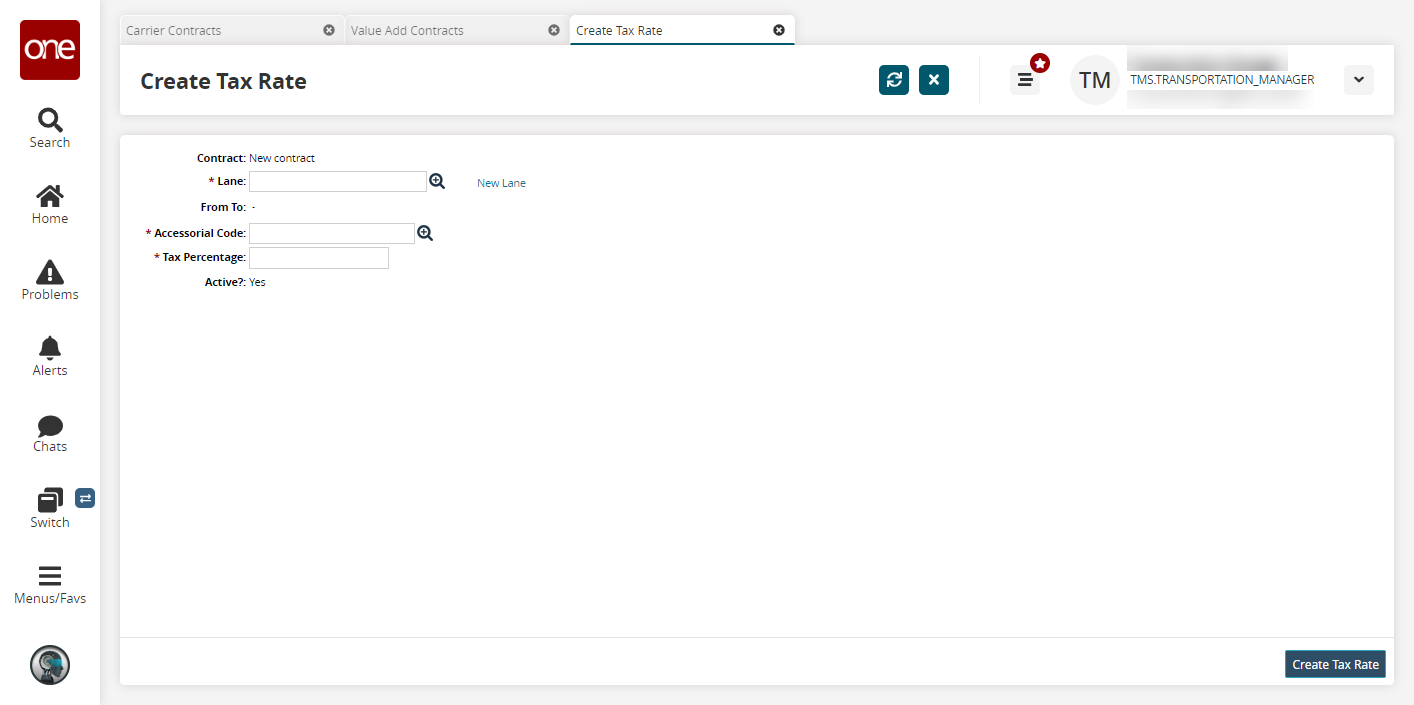

The Create Tax Rate screen appears.

Select a Lane using the picker tool or click New Lane to enter a new lane.

Select an Accessorial Code using the picker tool.

Enter a Tax Percentage.

Click Create Tax Rate.

A success message appears.